Calculations RM Rate TaxRM 0-2500. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month.

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions.

. Individual Income Tax In Malaysia For Expatriates Malaysia Tax Revenue 1980 2022 Ceic Data. The key issue that one should pay attention when claiming a tax deduction is whether the expenditure is wholly and exclusively incurred in the production. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

Donations to charities sports bodies and approved projects Donations that fall under these categories are restricted to 10 of your aggregate income. The deduction is limited to 10 of the aggregate income of that company for a year of assessment. Gift of money to approved institutionsorganisationsfunds.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Fines and penalties Fines and penalties are generally not deductible. Charitable contributions Donations to approved institutions or organisations are deductible subject to limits.

The legislation dealing with the general deduction is stated in Section 331 of the ITA. Determine your gross monthly revenue. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay.

This enables you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. A salary deduction usually includes tax social security contributions national insurance scheme and may also include pension fund contributions. Malaysias tax season is back with businesses preparing to file their income tax returns.

On the First 2500. Step 2 Calculate your net taxable income by subtracting all of your deductions. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2022.

On the First 5000 Next 5000. Section 331 of the Income Tax Act 1967 ITA reads as follows. Salary deduction refers to the amount withheld by an employer from an employees earnings.

Individuals are allowed to tap into a deduction of RM2000 for each child who is unmarried 18 years of age and above and receiving full-time education. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. The Malaysian Inland Revenue Board issued a set of updated frequently asked questions FAQs on the special tax deduction available for landlords that provide a rental reduction of at least 30 to small and medium-sized enterprise SME tenants and regarding business premises rented to non-SMEssupport offered in response.

Generally you are only taxed for the profit that you or your business earns. Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News. March 1 2021.

Thats a difference of RM1055 in taxes. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of your aggregate income to reduce your chargeable income. Personal deductions Non-business expenses for example domestic or household expenses and taxes are not deductible.

For income tax filing in the year 2021 YA 2020 you can deduct the following contributions from your aggregate income. On the First 10000 Next 10000. Additional deduction for purchase made within the period of 1st June 2020 to 31st December 2020.

PCB EPF SOCSO EIS and Income Tax Calculator 2022. 19 rows Subscriptions to associations related to the individuals profession are deductible. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Tax is governed strictly by tax laws which in Malaysia is principally the Income Tax Act 1967 ITA. Finding out what your net taxable income is is the third step. Receiving further education in Malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses.

Income Tax in Malaysia in 2022. According to Section 241 from the Employment Act 1955. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

The Five-Step Process for Calculating Your Income Tax Step 1. Heres the list of contributions that can qualify for tax deductions under Donations Gifts. On 11 May 2021 the Income Tax Deduction for Training Costs under the Professional Training and Education for Growing Entrepreneurs PROTÉGÉ-Ready to Work RTW Programmed Rules 2021 was gazette and work retrospectively from 11 September 2019 to replace the previous deduction given on Training Cost for Skim Latihan 1 Malaysia.

As such theres no better time for a refresher course on how to lower your chargeable income. The Law on Salary Deduction. How do you calculate total tax deductions.

Meanwhile you can claim RM8000 if you have children who are unmarried 18 years of age and above and meet any of the following criteria. Take note of your yearly gross pay which you will get next.

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

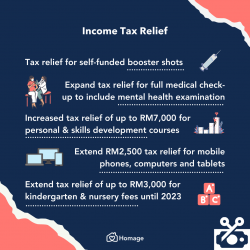

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Latest News Chartered Accountant Latest News Accounting

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

How To Gain From Higher Tax Deduction Limits Businesstoday Issue Date Dec 01 2014

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Personal Tax Relief 2021 L Co Accountants

Updated Guide On Donations And Gifts Tax Deductions

Malaysia Personal Income Tax 2021 Major Changes Youtube

2019 Personal Income Tax Deduction Category Asq

You Can Claim These Tax Reliefs For Year Of Assessment 2020

How To Sell Online Payslips To Your Employees

Expanded Meals And Entertainment Expense Rules Allow For Increased Deductions Our Insights Plante Moran

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

15 Tax Deductions You Should Know E Filing Guidance Financetwitter